26 May, 2025

Managing your business money doesn’t have to be complicated.

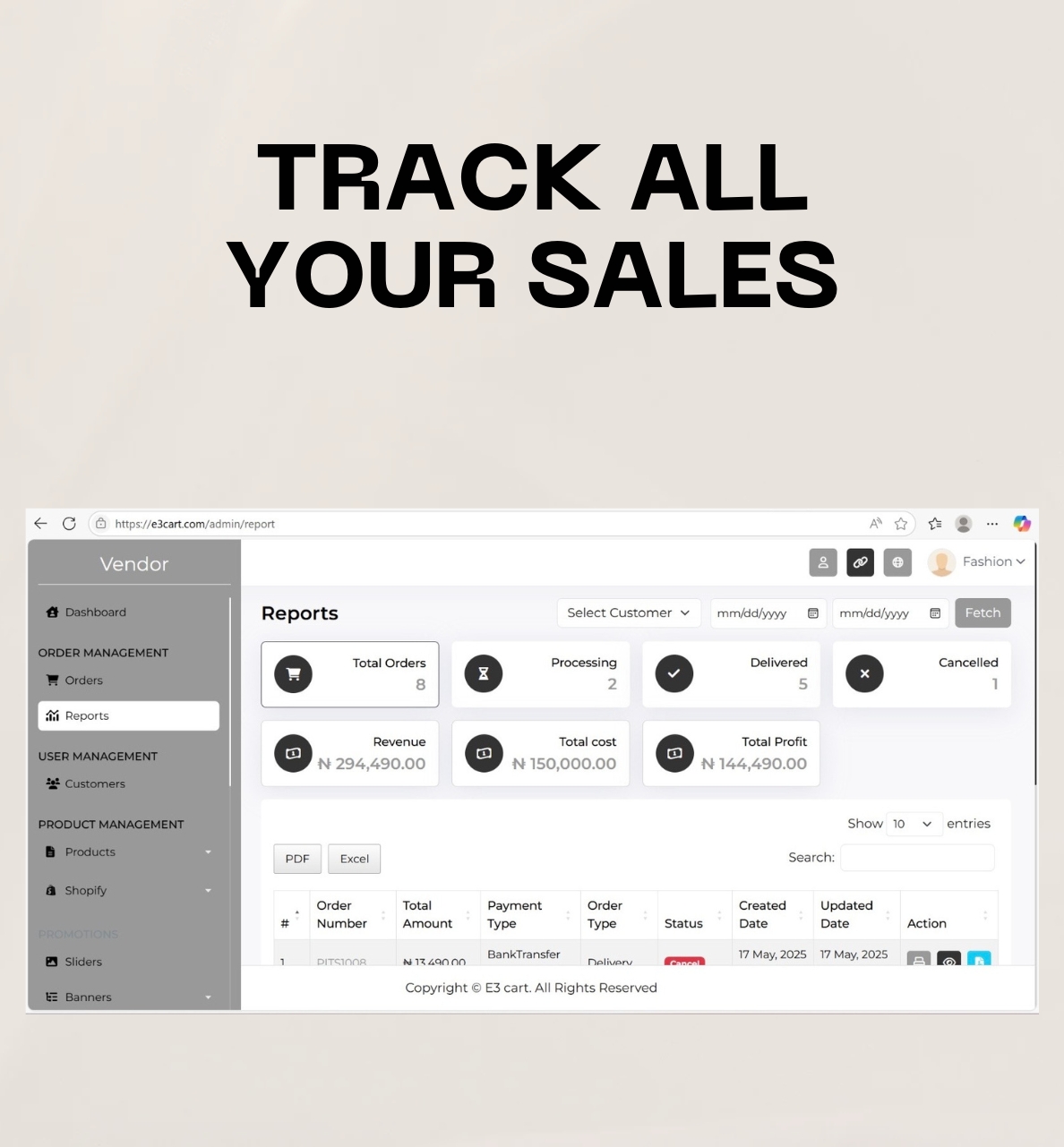

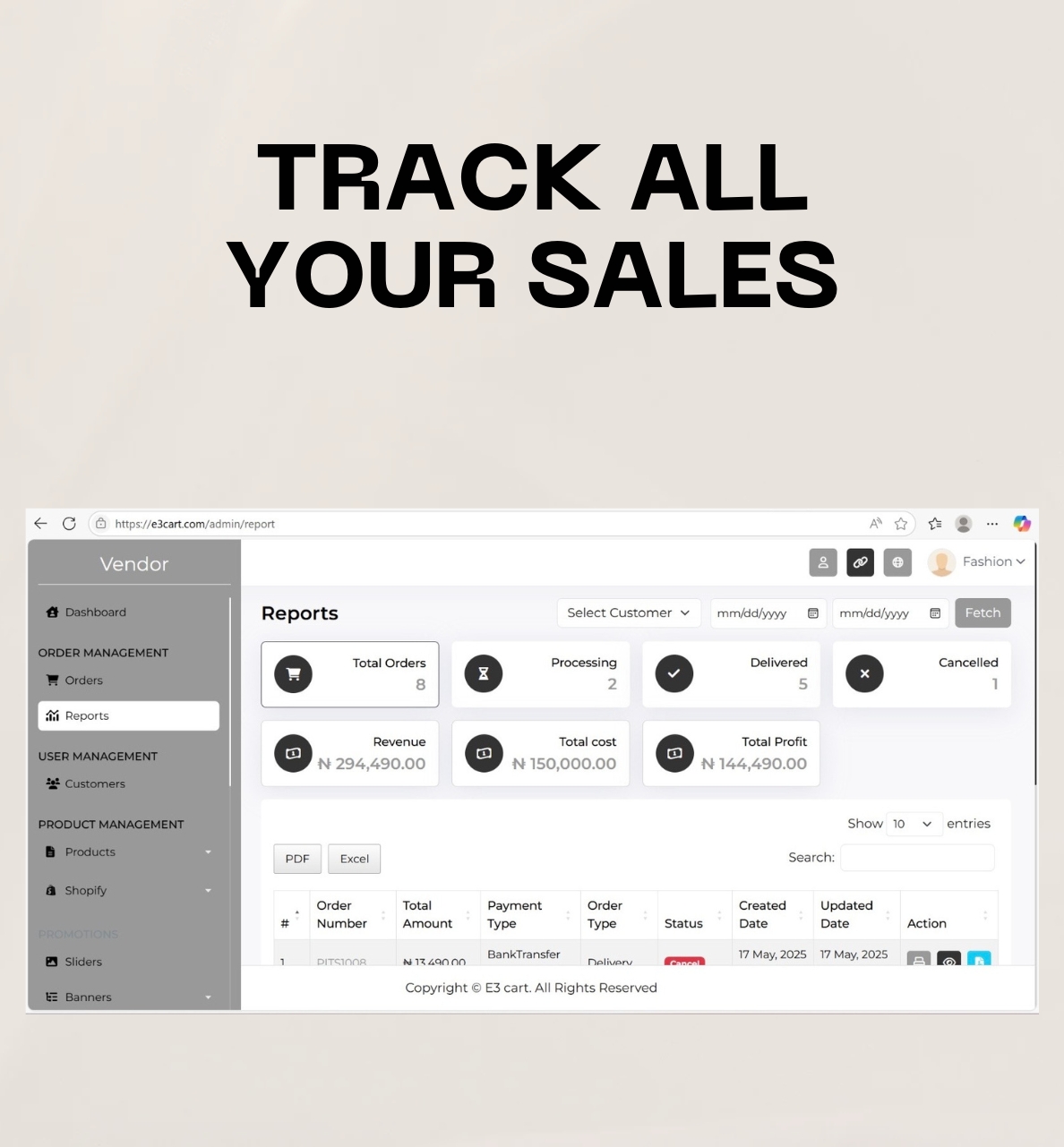

With E3 CART, you can easily track expenses, monitor sales, make smarter financial decisions, and avoid common financial pitfalls.

Did you know that 60% of Nigerian businesses shut down within their first three years? Surprisingly, the issue often isn't a lack of sales. In fact, your business could be making money and still be heading toward failure.

No it’s not your village people either.

The real problem? Most entrepreneurs neglect the fundamentals of financial management. You may think your business is profitable, but if you’re not paying attention to the right numbers, you could be running at a loss. Your store might be full of customers, and your services might be in demand but without proper tracking, that “profit” could just be a mirage.

In this article, we’ll cover seven costly financial mistakes hurting Nigerian businesses and most importantly, how to fix them.

Cash flow is like the bloodstream of your business. When it’s not flowing properly, everything suffers. A major problem for many entrepreneurs is mixing personal and business finances, making it nearly impossible to understand their financial standing.

How to fix it:

Use a business management app to monitor your spending

Open a separate business bank account

Set up reminders for recurring bills

Implement a digital invoice system

Review your cash flow weekly

With E3 CART, you can easily categorize your expenses for example:

Inventory (stock, delivery costs)

Operations (rent, electricity, data)

Marketing (ads, fliers)

Staff (salaries, training)

Snap photos of receipts or enter expenses on the go, and track every kobo effortlessly.

Think back to the COVID-19 lockdowns. Businesses without savings struggled to survive. Yet many SMEs still operate paycheck to paycheck, with no financial cushion.

How to fix it:

Save at least 10% of your monthly profits

Automate your savings transfers

Aim to build up 3 6 months of operational expenses

Keep your emergency fund in a separate account

Relying on notebooks, mental math, or random spreadsheets isn’t enough anymore. Lose that notebook and you risk losing critical financial data like your inventory, revenue history, or even tax records.

How to fix it:

Switch to digital bookkeeping

Scan and store all receipts using your phone

Log expenses daily

Generate monthly financial reports

Back up your records automatically

With E3 CART, you can digitally track all your sales, orders, and inventory. You’ll also get performance reports and daily expense tracking all in one place.

Are you truly making a profit on each sale?

It’s possible to sell a lot and still not have enough to sustain your business. That’s because high sales don’t always mean high profit especially if you’re not paying attention to your profit margins.

Your profit margin is what you keep after subtracting all costs. For example, selling a shirt for ₦5,000 that costs ₦3,000 to produce gives you a ₦2,000 (or 40%) profit margin. The higher your margin, the better.

How to fix it:

Calculate all costs per product/service

Track which items perform best

Set alerts when margins drop

Adjust pricing based on real data

Review margins monthly

Unpaid invoices can crush your cash flow. When customers delay payments for weeks or months, you’re left struggling to restock, pay staff, or settle bills.

How to fix it:

Establish clear payment terms

Send automated payment reminders

Offer incentives for early payments

Accept multiple payment options

Use digital invoices for faster processing

E3 CART’s Payment Request feature helps you stay on top of this sending your customers a reminder with a payment link so they can pay faster and easier.

Running a business without a financial plan is like flying blind. Too many SMEs react to financial issues instead of planning ahead.

How to fix it:

Create monthly and annual budgets

Set realistic income and expense targets

Compare actual results against your plan

Review and adjust your plan quarterly

You’re excellent at your craft but that doesn’t mean you should manage all your finances solo. Many entrepreneurs try to handle everything, which leads to missed opportunities and costly errors.

How to fix it:

Invest in business management software like E3 CART

Learn basic financial principles

Automate your financial reports

Hire a part-time accountant if needed

Attend finance workshops for business owners

What sets successful businesses apart isn’t just great products or loyal customers it’s smart financial habits.

With E3 CART, you can:

Track your cash flow with ease

Get paid faster with professional invoices

Make smarter pricing decisions with real data

Build emergency savings

Generate instant, insightful financial reports

Don’t let poor financial habits hold you back. Start managing your money the smart way. Download the E3 CART app and take control of your business today!

If you enjoy helpful tips like these for growing and managing your business, you’ll love our blog! Get notified when we post new content by subscribing with your email. We won’t spam you and you can unsubscribe anytime.

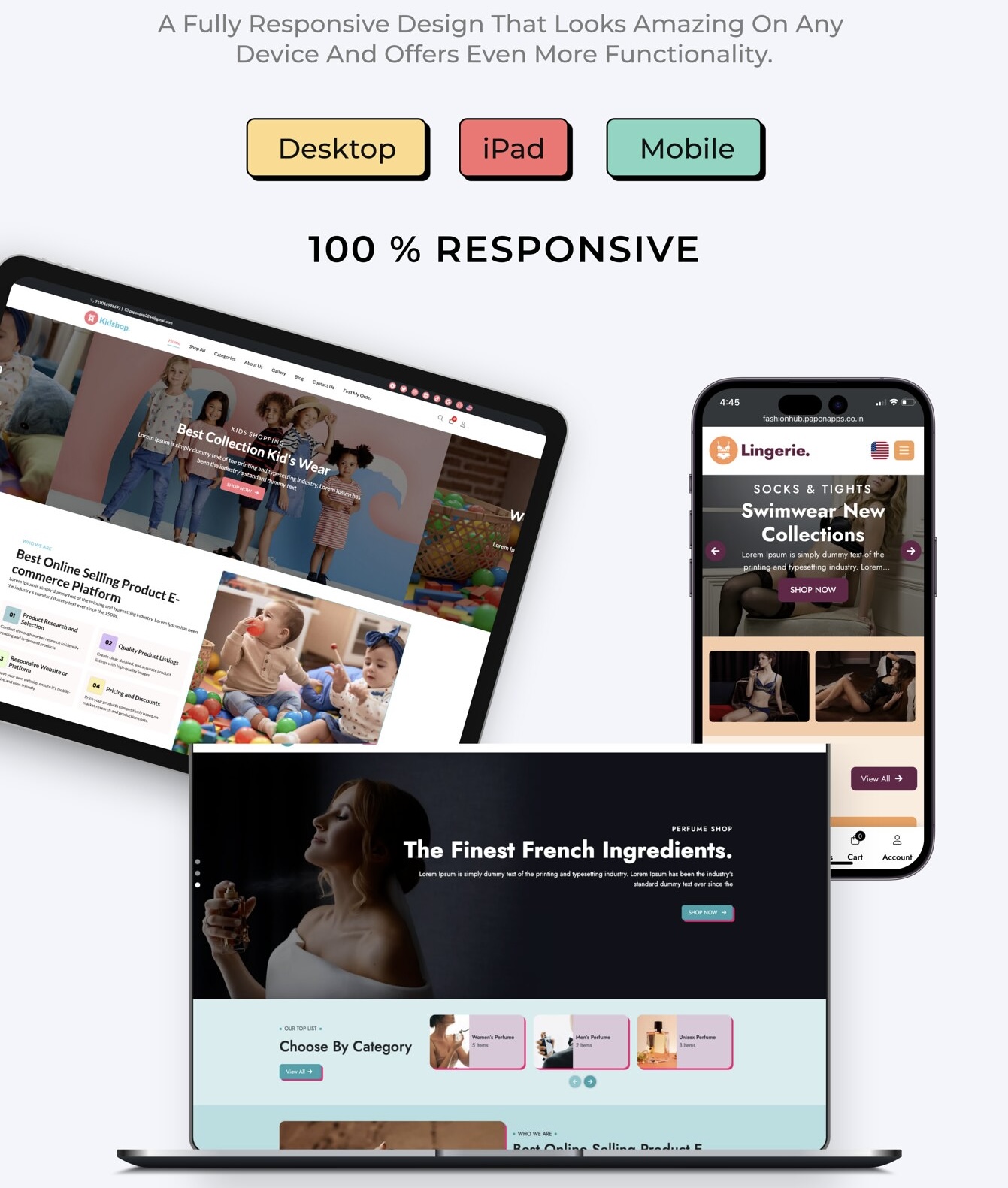

Signing up is quick and easy. In just five seconds, you can start using E3 CART to manage and grow your business smarter, faster, and better.

Launch Your E-Commerce Website in MinutesStart Selling Today! Build

Take Control of Your Business Finances with E3 CART Managing your b

Stay updated with the latest news, tips, and exclusive offers. Subscribe to our newsletter today!